Accountant Resume – Writing Guide & Example for 2024

Creating an effective resume for an Accountant position requires a focus on your financial expertise, attention to detail, and experience with accounting software. Here’s a guide on how to craft a compelling Accountant resume, along with an example.

1. Start with Contact Information

- Full Name

- Phone Number

- Email Address

- LinkedIn Profile (Optional but recommended)

- Address (City and State is usually sufficient)

2. Write a Strong Objective or Summary

- Objective (for less experienced candidates): A concise statement outlining your career goals and how they align with the accounting role. Example:

“Detail-oriented accounting graduate with hands-on experience in bookkeeping, financial reporting, and tax preparation. Seeking to leverage my accounting skills and knowledge to contribute to the financial accuracy and efficiency of [Target Company Name] as an Accountant.” - Summary (for more experienced candidates): A brief overview of your professional background, highlighting your key skills, achievements, and what you bring to the role. Example:

“Certified Public Accountant with over 7 years of experience in financial reporting, auditing, and tax preparation. Proven track record of ensuring compliance with financial regulations, improving financial processes, and delivering accurate financial statements. Seeking to apply my expertise to support the financial integrity of [Target Company Name].”

3. Highlight Your Professional Experience

- Company Name, City, State

- Job Title (e.g., Accountant, Senior Accountant, Staff Accountant)

- Dates of Employment (Month, Year – Month, Year)

For each role, include:

- Key Responsibilities: Focus on accounting tasks such as financial reporting, reconciliations, tax preparation, auditing, and budgeting.

- Achievements: Quantify your impact where possible (e.g., “Improved month-end close process, reducing time by 20%,” “Recovered $50,000 in tax overpayments through detailed analysis”).

- Software Proficiency: Mention the accounting software you’ve used (e.g., QuickBooks, SAP, Oracle, Microsoft Excel).

4. Education Section

- Degree (e.g., Bachelor of Science in Accounting, Finance)

- University Name, City, State

- Graduation Year

If relevant, you can also include certifications or courses that enhance your qualifications, such as advanced accounting courses or workshops.

5. Certifications and Licenses

List any relevant certifications such as:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Enrolled Agent (EA)

Include the certifying body and the year of certification.

6. Key Skills

Include a list of your key skills, focusing on those most relevant to the Accountant role:

- Financial Reporting & Analysis

- General Ledger Accounting

- Tax Preparation & Compliance

- Budgeting & Forecasting

- Accounts Payable/Receivable

- Reconciliations

- Auditing & Internal Controls

- Payroll Management

- Accounting Software (e.g., QuickBooks, SAP, Oracle)

- Advanced Microsoft Excel (VLOOKUP, PivotTables, Macros)

7. Optional Sections

- Professional Affiliations: Include memberships in professional organizations related to accounting, such as AICPA (American Institute of Certified Public Accountants) or IMA (Institute of Management Accountants).

- Awards and Honors: Mention any relevant awards or recognitions received in your career.

- Languages: If you speak multiple languages, especially if relevant to the job.

- Volunteer Work: Highlight any accounting-related volunteer activities.

8. References

You can include a statement like “References available upon request,” or provide references if requested by the employer.

9. Formatting Tips

- Keep it Concise: Aim for a resume length of one page, two if you have extensive experience.

- Use Bullet Points: This makes your resume easier to scan quickly.

- Consistent Formatting: Use a consistent font, spacing, and format throughout your resume.

- Professional Design: Use a clean, simple resume template that highlights your information clearly.

Final Tips

- Tailor Your Resume: Customize your resume for each job application, emphasizing the skills and experience most relevant to the job description.

- Use Action Verbs: Start each bullet point with a strong action verb (e.g., “Prepared,” “Analyzed,” “Reconciled,” “Managed”).

- Proofread: Ensure your resume is free of typos and grammatical errors.

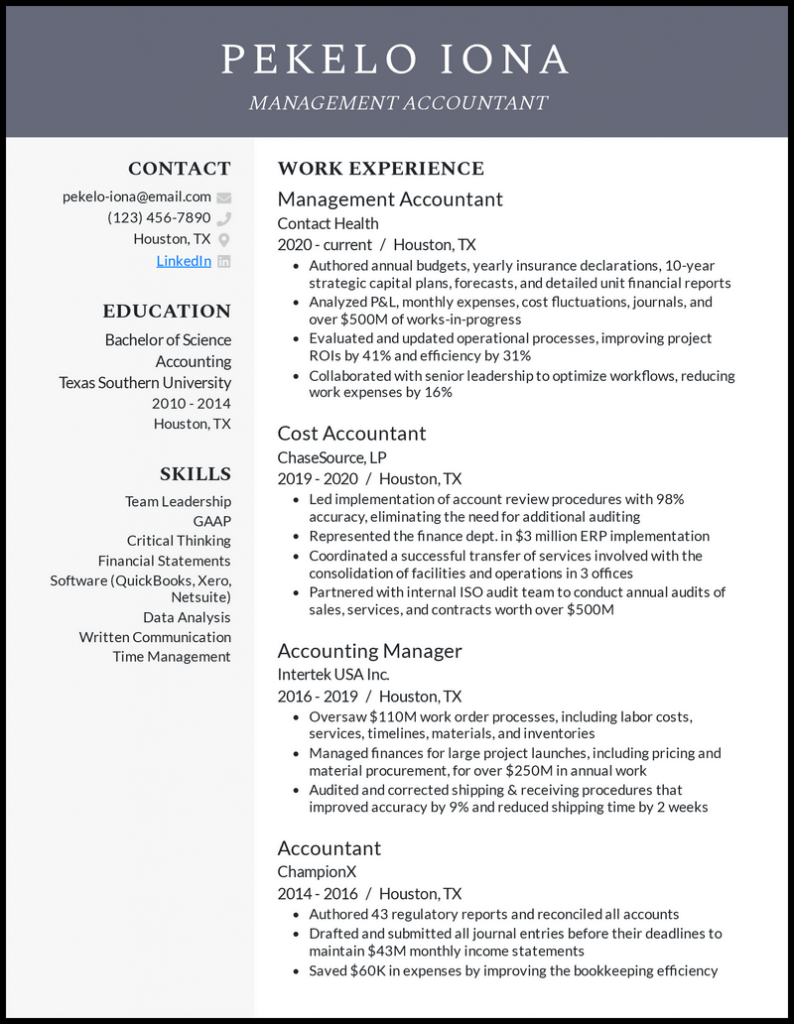

Example Resume: Accountant

John Smith, CPA

123 Main Street

City, State 12345

johnsmith@email.com

(123) 456-7890

LinkedIn Profile

Summary

Certified Public Accountant with 8 years of experience in financial reporting, tax compliance, and auditing. Adept at managing financial operations, performing reconciliations, and ensuring accurate financial statements. Proven ability to identify process improvements and reduce costs. Seeking to leverage my expertise in a challenging Accountant position at [Target Company Name].

Professional Experience

Senior Accountant

XYZ Corporation, City, State

March 2019 – Present

- Lead the month-end close process, ensuring timely and accurate financial reporting in compliance with GAAP.

- Prepare and analyze financial statements, balance sheets, income statements, and cash flow statements.

- Manage tax preparation and filing, ensuring compliance with federal, state, and local regulations.

- Reconcile general ledger accounts, identifying and resolving discrepancies to maintain accurate financial records.

- Supervise and mentor junior accountants, providing training and guidance on accounting best practices.

Staff Accountant

ABC Financial Services, City, State

July 2015 – February 2019

- Assisted in the preparation of monthly financial reports, including income statements, balance sheets, and cash flow analyses.

- Managed accounts payable and receivable, ensuring timely and accurate processing of invoices and payments.

- Conducted monthly bank reconciliations, identifying and addressing discrepancies.

- Supported the annual audit process by preparing necessary documentation and working closely with external auditors.

- Prepared and filed tax returns, ensuring compliance with relevant tax laws and regulations.

Education

Bachelor of Science in Accounting

State University, City, State

Graduated: May 2015

Certifications

- Certified Public Accountant (CPA) – State, 2016

- Certified Management Accountant (CMA) – 2017

Skills

- Financial Reporting & Analysis

- General Ledger Accounting

- Tax Preparation & Compliance

- Budgeting & Forecasting

- Accounts Payable/Receivable

- Reconciliations

- Auditing & Internal Controls

- Payroll Management

- Accounting Software (QuickBooks, SAP, Oracle)

- Advanced Microsoft Excel (VLOOKUP, PivotTables, Macros)

Professional Affiliations

- Member, American Institute of Certified Public Accountants (AICPA)

- Member, Institute of Management Accountants (IMA)

References

Available upon request.

This example resume highlights your ability to manage financial operations, ensure compliance, and support financial decision-making processes. Tailor it to your specific experiences and the requirements of the job you’re applying for

Get your free resume analysis from our expert team today to ensure that you never miss your chance to make a great first impression!

- 9 Solutions Architect Resume Examples for Your Job Search

- How to Find the Right Keywords to Beat the ATS (Applicant Tracking System)

- Resume Writing Tips to Help You Stand Out

- Best Resume Formats for Jobs: Examples and Templates

- How to Write a Recent Graduate Resume: A Comprehensive Guide with Examples